Blockchain is going to change everything more than the internet has..

-Brock Pierce

A wise person once said – the old question ‘Is it in the database?’ will be replaced by ‘Is it on the blockchain?’. As a matter of fact, this situation is already changing, and many are a witness to it. The concept of blockchain has revolutionized the banking industry. And to be frank, blockchain is the present and the future of technology.

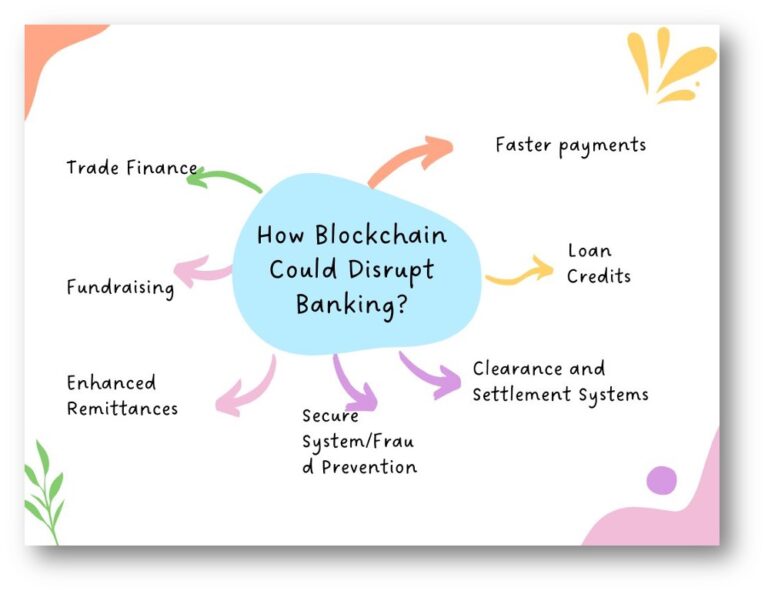

The reason blockchain has received such applause is that it aids in verification and makes the process of traceability a piece of cake. Let’s be honest, in today’s world, these two processes have become the need of the hour. Now, let’s talk numbers. Within a matter of a few months, the worldwide spending on blockchain solutions will reach a whopping amount of $11.7 billion. And by 2024, this market is predicted to garner a revenue of over $20 billion. These figures talk for themselves and give us more than enough reasons to embrace this technology. Being a part of this will surely be beneficial for all. Right from the realm of medicine to the world of art, everyone is striving hard to incorporate blockchain in their operations. When they know the returns are priceless, it is imperative to integrate them. The emergence of blockchain converts any process into a secure, sellable asset. And why should the banking industry stay take a backseat when it comes to blockchain? The advantages of using blockchain in banking are immense. It increases security and speed, traceability, fraud prevention, manages risks etc. Here are the reasons why blockchain will change the world of banking.

1. Faster payments

Many have been seen yawing while completing a banking process. Well, such kind of user behaviour is a sign that the banking system should take into consideration the user’s time. Incorporating blockchain enables transactions without a mediator or correspondent. This makes the payments faster, at a lower fee, and ensures customer satisfaction. Particularly when it comes to international payments, some banks take a backseat. This decentralized ledger payment provides a solution for time and money as well. Once this problem is solved, banks don’t have to worry about third-party verifications. This makes the process faster and easier. Bicton Cash and TRON enable users to enjoy low-priced transactions. Considering the average banking payment system, Bicton takes merely 10 mins, barely hours in worst cases. That’s something to think about.

2. Loan Credits

Blockchain is legit helping us break barriers. From busting the myths to securing the future of the users, this technology surely streamlines all the processes. Traditionally, to underwrite loans, a credit reporting system was a must. As blockchain opens up new doors of opportunities, the possibility of faster and peer-to-peer lending, and other processes can surely come to reality.

3. Clearance and Settlement Systems

When it comes to transporting money internationally, one only hopes that the process to be hassle-free, secure, and quick. A normal bank transaction takes a toll on a person, imagine what sort of impact it would have will sending money across the world. That’s when Blockchain makes an entry. It has the leverage to make the transaction secure and swift. The icing on the cake being Distributed ledgers has the potential to even reduce operational costs. There are stories where blockchain has showcased its ability to overcome unforeseen problems and associated risks. For the digital assets to get more clarity, the banking industry should invest in this system.

4. Enhanced Remittances

Remittances play a great role when you consider a country’s GDP. As per a report by Dev.Team.Spaces, the remittances money involved is somewhere around $1 trillion. Let’s break it down, Haiti has one of the world‘s highest remittance vs. GDP rates, some 29% of its entire GDP.

In the Philippines, it is at just over 10% while in Mexico it is 2.7%. When put into perspective, remittances account for 0.7% of the entire world’s GDP each year. The amount indeed is mind-blogging. And if this money is handled efficiently, it can create a source of income for millions in developing nations. As a study published by OECD, the use of blockchain while handling remittances efficiently gains cost reduction and improved customer experience in the process of onboarding a customer.

Although there are a few banks that still handle this with the MTO-Model, there are several that operate using blockchains such as Abra, BitPesa, and Circle. The outcome will surely benefit all.

5. Secure System/Fraud Prevention

With every invention in technology, there comes the aspect of fraud that always haunts people. As per the United Nations, around US$2.6 trillion is stolen through corruption and an estimated US$1 trillion is paid in bribes. It is said that an organization loses 5 per cent to fraud each year. What blockchain brings to the table is security owing to its decentralized storage of information. Further, as it stores customer information in different blocks, it plays a great role in safeguarding customer details. And integrating smart contracts also ensures safety measures. Adhering to ‘Know your Customer’ (KYC) adds to fraud prevention where blockchain can showcase its talent.

6. Fundraising

Captial-raising is crucial for any organization. But many know this process to be lengthy, time-consuming, and exhausting. Addressing the financial market evolution, companies that use blockchain to enhance this process have seen a positive impact. They can leverage options such as Equity Token Offerings (ETOs), Initial Exchange Offerings (IEOs), and the latest sensation and one of the most used options Security Token Offerings (STOs) (STOs). STOs offer impartiality, support innovation, and transparency all the while keeping the integrity intact. Although, ICOs rose high when they came into the market. In 2019 it raised $371 million which is almost 95 per cent less than the year before.

7. Trade Finance

When someone utters the word bank, invariantly, one pictures tonnes of paperwork apart from the fact that the process is tedious. The advent of blockchain will certainly make the trade finance industry more alluring and all things good.

• Smart contracts will make the flow of the process less cumbersome and reduce the number of human errors.

• This will surely lend a helping hand to security. Further ensuring the clients’ and employees’ peace of mind

• Improved transparency will boost the trust

Read more: https://www.cbinsights.com/research/blockchain-disrupting-banking/#securities

Final thoughts

Change doesn’t happen overnight. For blockchain to become a mainstream method in banking, this process has to tick off several boxes and build a reliable ecosystem. This process can disrupt the industry only if it woes the customers. Once this process settles in, the returns will sky-rocket. To know more contact our experts at https://www.app-scoop.com/contact-us.html