ReferenceSource:https://www.sap.com/cmp/dg/innovation-is-live/index.html?url_id=banner-DTES_Banner_4_Ways-News_Center-2017_DTES-Oxford_Report

We’ve already covered a few challenges faced by the insurance industry, let’s recap the most concerning ones:

- Privacy issues from underwriting to claims processing

- Limited growth in mature markets

- Data management while client onboarding

- Identity management

- Fraudulent claim activity

Now, let’s take a look at how Blockchain can help combat these challenges faced by the insurance industry.

Blockchain – Making Insurance Industry Better

Leveraging Blockchain will help to promote transparency, trust and stability in this early stage of adoption. Let’s take a look at each point in detail:

Security

Suspicious and dubious transactions can be eliminated by logging each transaction with the use of a public ledger. The authenticity of the customer, policy and transactions can be verified through the decentralized digital repository. This secures the insurance companies from hackers who want to steal and corrupt files.

Smart Contracts

With the help of Blockchain, insurance companies connect real time information of contracts from multiple systems. It will allow the insurance company to even view physical documents and activities that apply for processes like claims, payments and reimbursements. This process is much faster and is done with greater accuracy, thereby, saving the insurance company time and money.

Big Data

Imagine the amount of data that insurance companies need to handle – especially with the introduction of the digital age. With the help of Blockchain, companies can now organize, store and protect data in secured fashion. Since, it is stored on Blockchain, the information – static or data without centralized coordination – can be viewed by all parties. This is possible because the user’s data creates a digital fingerprint using a date and time stamp which provides both transparency and security.

Third Party Transactions

It is easier for insurance companies to carry out third-party transactions and claims made through a digital device. Blockchain helps the insurance company to reduce administrative costs as the claim and payment is automated. Past claims can be easily viewed on Blockchain – promoting a higher degree of trust between the user and the insurance company.

Reference Source: https://www.idginsiderpro.com/article/3301163/how-blockchain-is-disrupting-the-insurance-industry-for-the-better.html

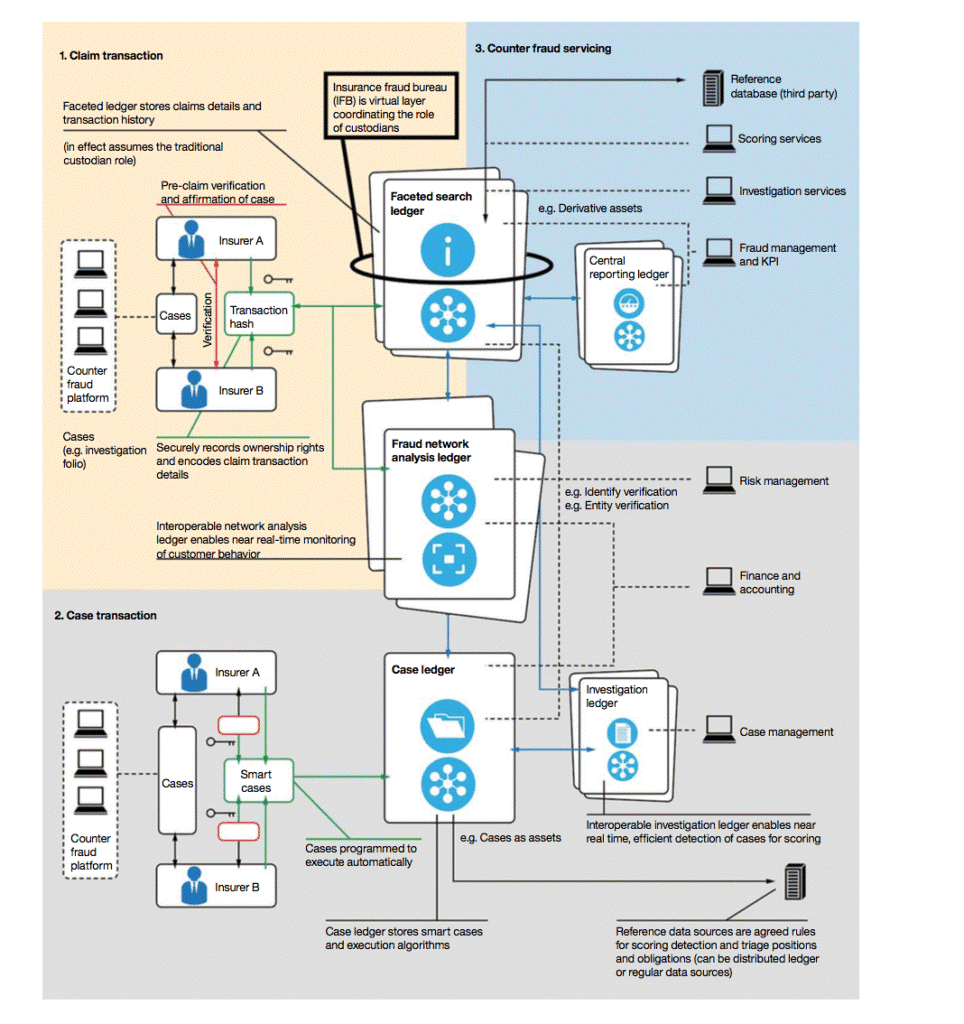

Fraud Detection

With the help of Blockchain it is easier for the insurance companies to detect frauds.

“On a distributed ledger, insurers could record permanent transactions, with granular access controls to protect data security. Storing claims information on a shared ledger would help insurers collaborate and identify suspicious behaviour across the ecosystem.”

Reference Source: https://www.cbinsights.com/research/blockchain-insurance-disruption/

Identity Management

While data is being fed into Blockchain, it is a must for ever user to fill in all their KYC details. The users have to fill a detailed document, which goes through an identify verification procedure. These details can be verified through Blockchain, by assessing the connected government databases. Every record will be secured and accessible to all the parties involved.

Blockchain Insurance Sector

Health Insurance

Blockchain loops in all hospitals and clinics, lab vendors, physicians and insurers in the application which makes it easier to streamline the “flow of health information for enhanced underwriting and claim validation”.

Life Insurance

Blockchain assembles death registrations and death claim procedures which helps streamline the claim settlement.

Travel Insurance

Blockchain puts together a data centre that has all the travel agencies, airlines, other travel departments and insurers under one umbrella which makes it easy for insurers to check facts and process or deny the claim.

Home Insurance

Blockchain stores all the retail estate details which makes it faster for them to verify and process home insurances.

Wrapping It Up

Blockchain is the future of secure technology that is yet to sweep over the world. If you wish to know more about how Blockchain can be used for disrupting the insurance industry for the better, you can contact the App Scoop mobile app development team on: https://app-scoop.com/contact-us.html