Digital Transformation in Banking

The financial sector is not free from the repercussions felt by the global digital wave. The first digital value add was SMS banking in 1999. After nearly two decades, the following services are now offered:

- SMS Alerts

- Account information

- Loan applications

- Payments

- Investments

- Customer support

Digital disruption is occurring at every level in the banking industry, from new technology to heightened customer expectations leaving incumbent banks vulnerable and hence these financial institutions need to find a way to deliver novelty in their customer experience.

Advantages of Digital Transformation in Banking

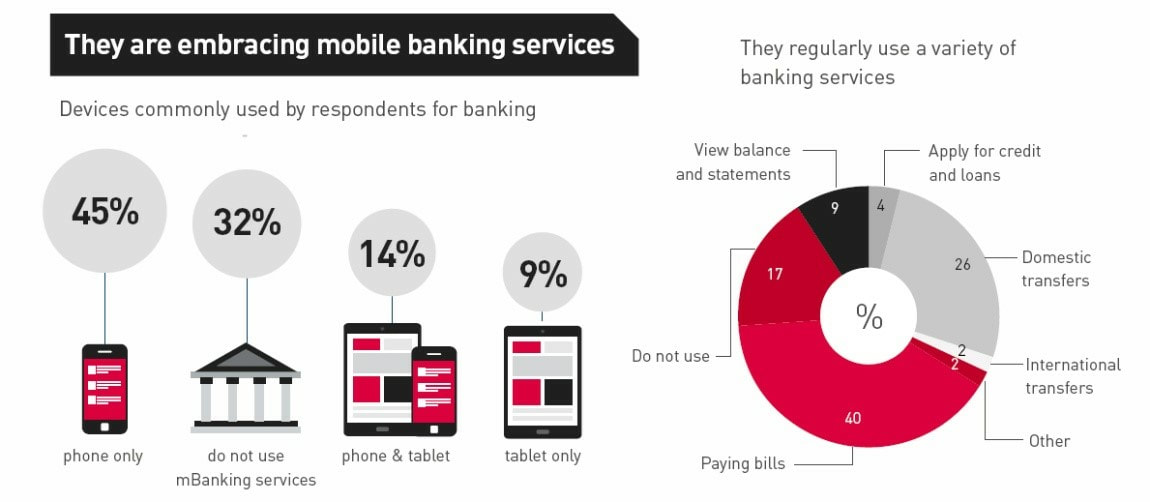

Most consumers are now ready for a higher level of digital engagement from their banks as they interact with the digital channels regularly. Globally, branches and ATMs are being used more infrequently by all demographics. This should be considered as an opportunity for banks to improve their digital offerings and increase customer engagement.

New Customer Segment

Millennials today are the largest segment of smartphone users. Approximately 92% of them use smartphones. This allows them to appreciate the ease and efficiency of mobile apps, when it comes to daily tasks. Apart from the older client base, the new generation from 18-35 years would be an ideal target audience for a mobile wallet or a digital bank.

Source:http://www.pewresearch.org/fact-tank/2018/05/02/millennials-stand-out-for-their-technology-use-but-older-generations-also-embrace-digital-life/

Customer Engagement and Enhanced Customer Experience

Digital transformation allows banks to offer customised and tailored alerts to clients based on their spending and usage. It is a more proactive approach to ensure client satisfaction and engagement.

Troubleshooting

Addressing queries and troubleshooting problems has never been easier with the digital revolution. Customers get their issues handled on priority via an app whenever and wherever they may be.

Increased Security

In case of any fraudulent or suspicious behaviour, technology today has made it possible for any transaction to be frozen or verified via the mobile. Using tools like biometric passwords and PINs offers a higher level of security for online transactions.

Accelerating Digital Transformation

The number of people using mobile phones, in Canada alone, is said to increase to 28.6 million by the year 2021. Based on this, it is safe to say the number of online banking users will also increase and hence banks need to implement a digital agenda which enables them to be relevant at all times and consistent in fulfilling of customer experiences.

Source: https://www.statista.com/topics/3529/mobile-usage-in-canada/

While many banks are falling behind, those leading the way are accelerating the transformation by leveraging platform technologies to rapidly add a layer of agility to systems, empower employees and enhance the customer experience.

There is a need for change in the interactions between a customer and their bank. Keeping in mind some of the advantages of using the banks apps, many customers expect this kind of connect with their bank as one of their trusted confidants.

The banking and financial markets need to change to fit the evolving society and the demands of its customers. Traditional banking providers will need to combine digital speed and convenience with human interactions to provide innovation and thoughtful caring at crucial moments in the customer’s journey.

Human interactions of course are important for milestone decisions and for more intricate problems. However, digital alteration makes it possible for personalizing a customers’ day-to-day interactions, thus building an emotional connect with the bank.

Globally banks are realizing that investment in digital technologies benefits customer acquisition and satisfaction. People no longer want to wait in lines and actually go to a bank for any work or queries. Banks now receive more deposits from mobile channels than from the physical branches.

Banks are no longer competing with others in the financial sector alone. They are also competing with other tech companies which offer digital services.

For example:

- Apple

- Amazon

Customers connect with these brands and invariably have higher expectations from their banks as a result. In order to keep up, banks need to engineer a digital experience which ultimately could translate into more clientele.

Wrapping It Up

The main aim of any business is ensuring customer satisfaction. With the intention of gaining their trust and ensuring they stay loyal, banks will certainly need to accelerate their digital transformation to serve their customers efficiently. This is one of the only ways to retain customers, strengthen their emotional ties with the bank and also reduce any friction they might have faced earlier.

In order to drive a holistic digital engagement and integration, banks will have to restructure their systems around the customers’ interactions at various stages. Banks would also need to expand their focus beyond increasing digital service offerings to ensure they convert into a truly effective digital organization.

New technology trends are disrupting the traditional banking systems and many organizations are in danger of being crushed if they do not embrace the digital transformation quickly. Most financial institutions believe that digital will fundamentally change banking and completely transform the industry’s competitive landscape.

If you would like to further discuss your digital banking transformation, you can contact App Scoop mobile app development team on: https://app-scoop.com/contact-us.html.