People often trade with little or no knowledge of this industry. And this costs them dearly. Cryptocurrencies are surely booming courtesy of Initial Coin Offering (ICO). And due to the hype, it is often seen that fresh investors enter into this treading water with an intent to make the most of the ICO. Unknowingly, the investor gets caught in the trap of fraudulent ICOs. Have a clear plan before setting your foot in ICOs. In the end, mistakes are inevitable but learning nothing from the mistakes is a crime. Cryptocurrency runs on the ‘high risk – high reward mechanism’. All we can say is commit your mistakes with the intent of learning.

3. Falling for crypto scams

Investing in wrong coins, trading on imposter websites, phishing scams, falling for scam emails, and following the wrong social media accounts are some of the deceptions that investors can fall for. According to a study by Chainalysis, over $ 7.7 bn worth of cryptocurrencies has been stolen from the investors worldwide. Their report further states, rug pull that is mostly associated with Decentralized Finance (DeFi) projects, have emerged to be a go-to scam. This scam amounted to 37 per cent (around $ 2.8 billion) in 2021, as opposed to just 1 per cent in 2020.

In another scam, Finico, a Russian Ponzi scheme, looted millions, while touting itself as an ‘automated profit-generation scheme’. Money could be invested in Finico using Bitcoin or by purchasing Tether (in-house currency) in three options. It was said, that Finico was led by a popular Instagramer Kirill Doronin. This Ponzi scheme lasted from December 2019 to July 2021. This brings us to the point that one shouldn’t invest before doing proper research.

4. Putting all eggs in one basket

Diversification is an established tenet of conservative investment. The world of crypto goes through several ups and downs, and one of the things that save the investor during such unprecedented time is diversification. Studies suggest that a 50 per cent drop in the price of Bitcoin is normal. And when the market plunges down, proper research followed by plan should be made before selling the coins. Diversification to an extent helps in risk management. Putting your money in just one coin is not a great move. Spreading your hard-earned money in different cryptocurrencies increases the chance of good returns.

Whether you earn the money through your salary or by mining cryptocurrency, it counts as a taxable income. People often surpass this process and avoid paying the required tax. Around August 2021, the founder of Crypto ICO, Bruce Bise, and Samuel Mendez plead guilty to tax evasion after raising $24 million from investors, the press release said. Such tax frauds have become quite common and should be avoided. If a person holds cryptocurrency for less than three years, as per the income tax slab, they ought to pay short term capital gain. Likewise, the profit after selling the crypto post three years is chargeable too. It is advisable to take a note and declare this money in the income tax returns.

6. Buying high, selling low

Another common mistake perpetrated by new time investors is that they buy the crypto while it is gaining momentum. But as the rate starts coming down, they panic and commit the mistake of selling it. This industry is highly unpredictable, and investors should learn to take a hit as well. Overcoming the ‘FOMO’ (Fear of Missing Out) will lead them far in this game.

Takeaways

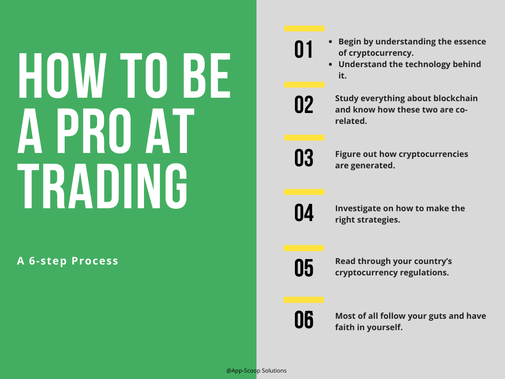

To sum up, it is always a smart move to invest in the right crypto at the right time. Also, spreading out your savings by investing in the different coins can surely help you multiply your wealth. As we mentioned, the cryptocurrency industry is quite unstable and fickle. The only thing that will lay the right path is gathering as much technical know-how as possible. Research till the time you are ready to invest. Always remember high risks rewards with high returns, be patient, your time will come too. With that, to have a secure future wealth after earning profits, don’t forget to pay taxes on the same. If you still have any further queries or looking to start investing in NFTs/cryptocurrencies, our App Scoop team is here to answer your questions. Contact: https://app-scoop.com/contact-us.html

References:

2 Comments

money · February 23, 2022 at 4:32 am

Appreciating the time and energy you put into your website and

in depth information you offer. It’s good to come across a blog every

once in a while that isn’t the same unwanted rehashed material.

Great read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

Marlena · April 20, 2022 at 10:55 pm

Great post

Comments are closed.