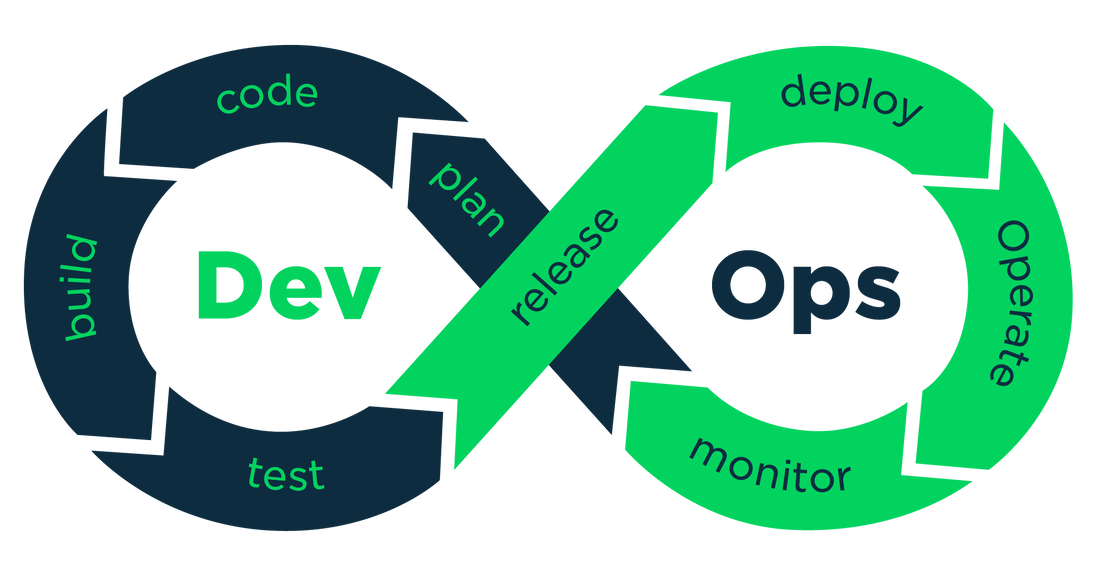

What Are DevOps?

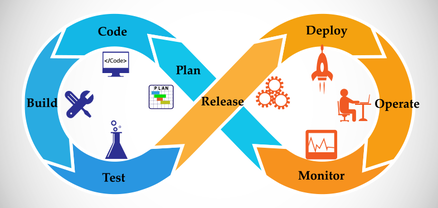

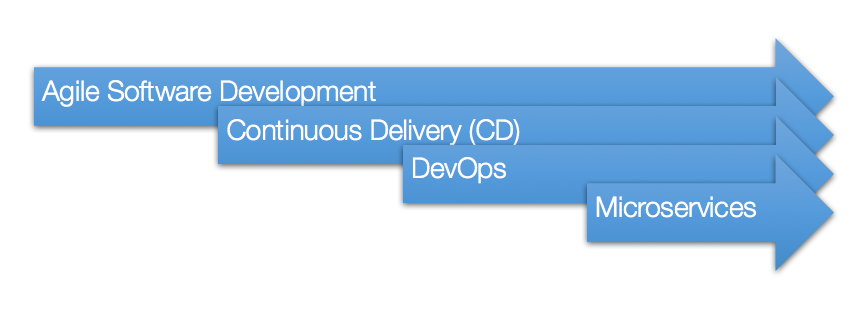

DevOps are a combination of processes, cultural philosophies, practices and tools which increase an organizations ability to deliver quality products and services at high velocity. It provides an automated system and infrastructure, helping the company evolve and improve products at a faster pace, than by using traditional developmental methods and processes.

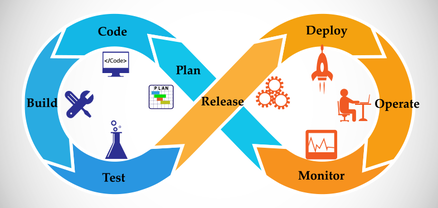

DevOps is considered to be a never ending process of continual improvement for an organization. The beauty here lies in enabling an organization to better serve their customers, compete effectively in the market and also provide more efficient ways to handle releases, issue resolution and better management of unforeseen work.

Image Reference Source: https://blog.testlodge.com/what-is-devops/

Image Reference Source: https://blog.testlodge.com/what-is-devops/

How Does DevOps Work?

In a DevOps model, the development and operations teams are no longer separate or “siloed”. These teams merge and form a single team where the developers are involved right from inception to testing and deployment.

In some instances, quality assurance and security teams are also integrated with development and operations where by archaic manual processes get automated and fast. The technology and tools used help companies evolve applications in a quicker and more reliable manner. All in all DevOps helps to increase a team’s velocity in launching as well as modifying products.

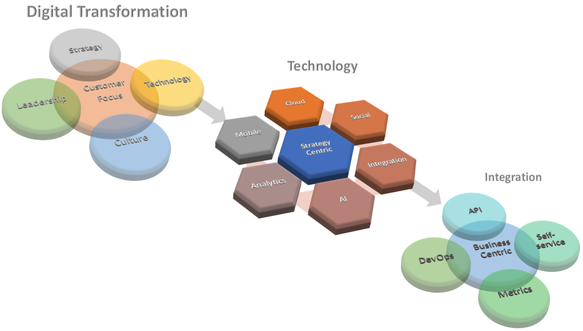

How Should You Implement DevOps?

Understanding the business value of DevOps has been simple, but developers are now focusing on how best to implement it. This is said to be slightly more complicated as the number and types of problem domains differ greatly from one problem domain to the next. The types of processes and tools that developers and operations professionals can apply differ a great deal as well.

Source: https://techbeacon.com/devops/7-steps-choosing-right-devops-tools

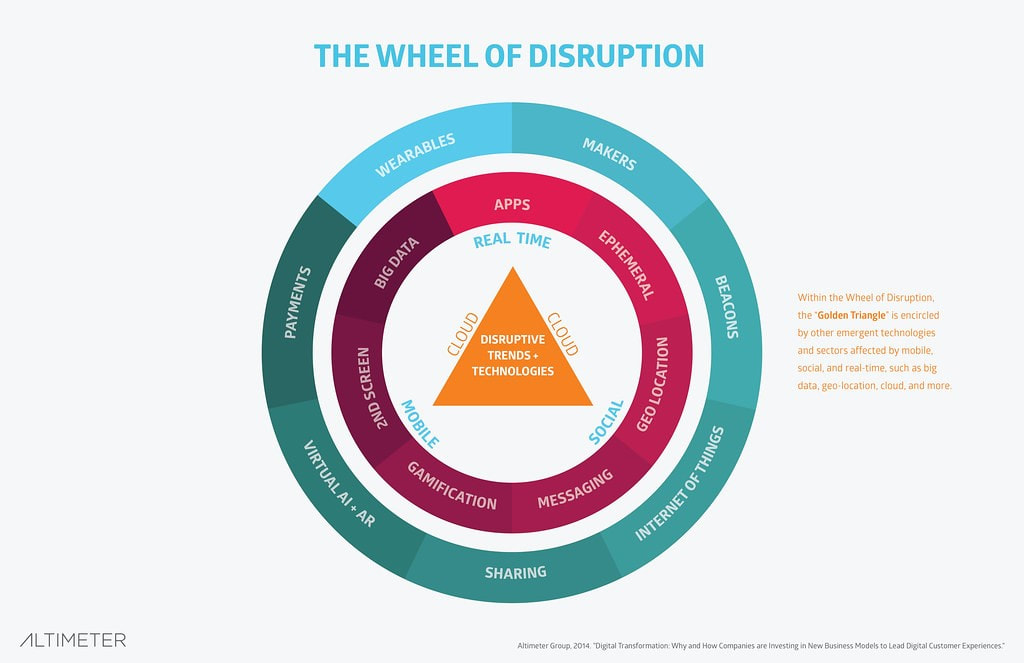

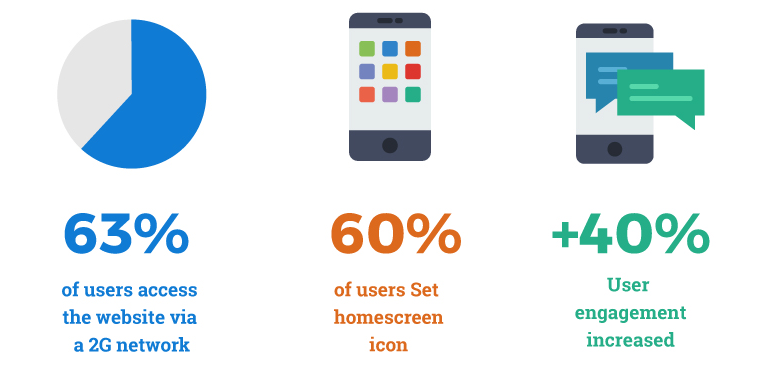

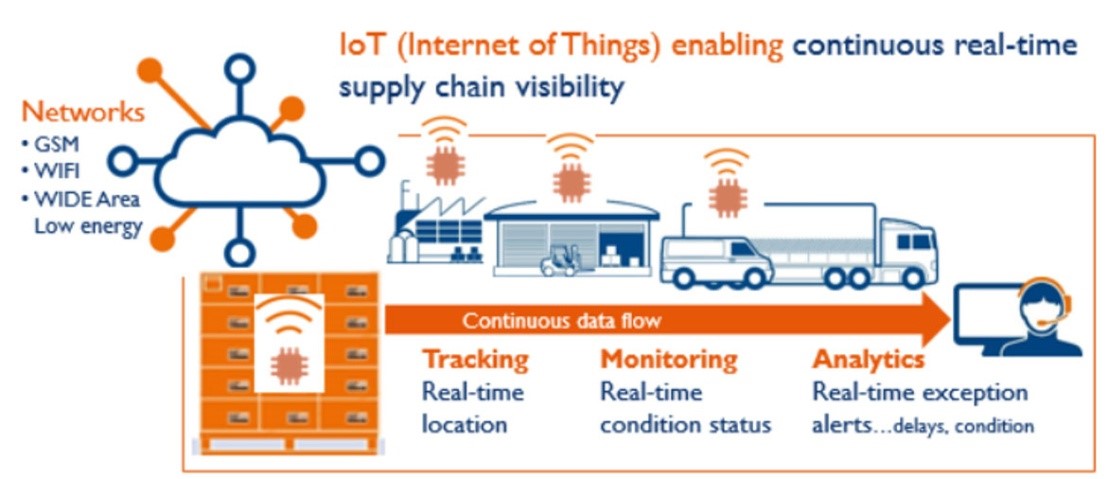

In today’s volatile market, DevOps practices are more important than ever, in part because of the growth of the Internet of Things, leading to an increase in pressure to deliver apps faster. It is the age of rapid releases and cultivating a DevOps strategy is in the best interest of businesses.

In Canada alone, people spend about $2500 a year on apps. The demand for mobile app development has grown more than five times and organizations need to evolve in order to have the capacity to deliver them.

Source: https://mobilesyrup.com/2018/11/28/canada-annual-mobile-app-spend-2018-study/

The DevOps teams need to be developed over time, much like agile practices are integrated into the company teams. A successfully integrated team has a common desire to improve, integrate and develop operations, processes and systems.

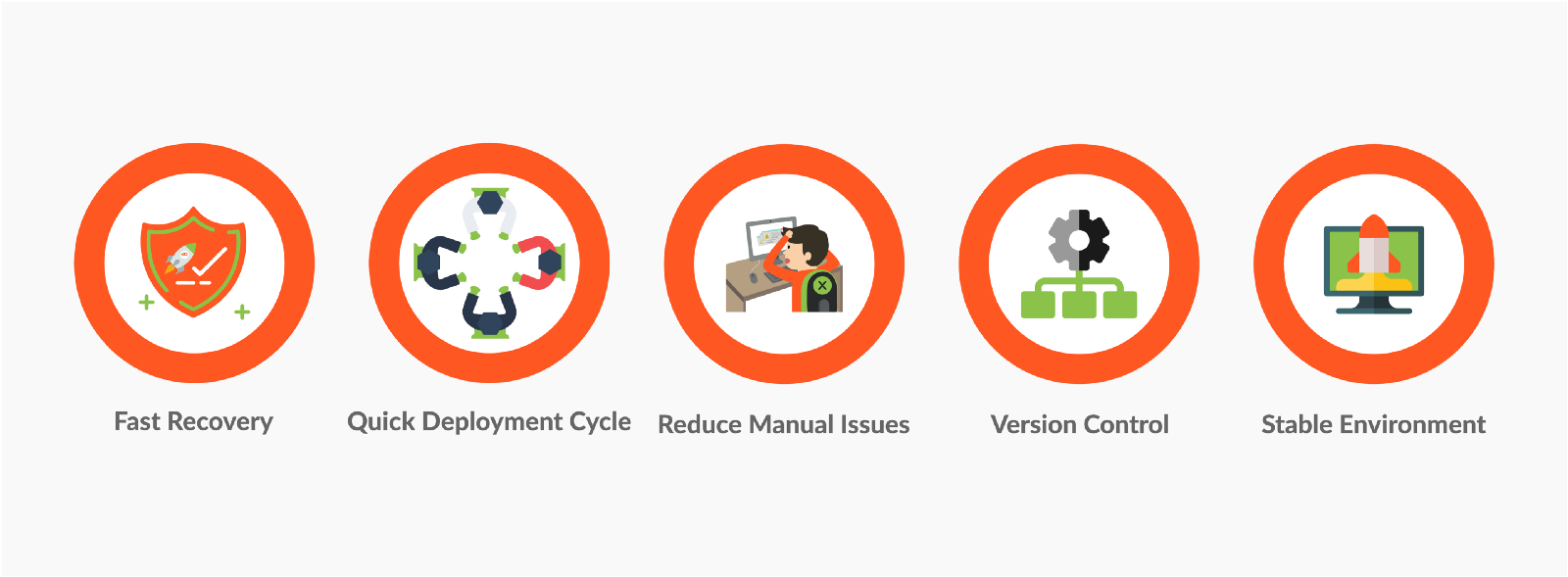

DevOps Best Practices

Image Reference Source: https://www.fpcomplete.com/blog/fintech-best-practices-devops-priorities-for-financial-technology-applications

DevOps is gaining attention and businesses worldwide are adopting and implementing this ideology for successful ventures. In order to consider this, a company would need to keep in mind that the core to a successful integration is having automated testing and deployment, while still maintain continuous feedback for improvement.

Let us look at the following 7 step guide for successful implementation of DevOps:

1. Understand Your Infrastructure and Start Small: Trying to make drastic changes in the organization at once would be a recipe for disaster. A company has its own culture and it cannot be changed overnight. Hence experts have recommended to cautiously start with a small project or team that would benefit from the DevOps practices.

This will help the company analyse the benefits and lay the foundation for the future DevOps efforts. The company can also evaluate what is causing problems in their development or deployment processes and based on this can recommend necessary solutions.

An early win can also help build team confidence and set an example for others to follow. The project allows management to ensure it processes adopted are meaningful and beneficial to the business.

2. Focus on Culture and Invest in Tools: As mentioned earlier, DevOps is about a cultural change and simply investing in automation will not give sufficient benefits or desired results. The trust and collaboration built between development and operations teams are the tools needed to achieve the goal.

Technology alone cannot solve problems. Tools are imperative for DevOps to be successful but they will not do any good alone unless there is a tremendous cultural change. Business objectives, communication and, above all, trust need to be emphasized before investing in technical solutions.

In order to encourage communication, a company must have necessary tools to allow everyone to see in real time how the project is progressing. The tools being used by teams must also be able to deploy and integrate together as together they are supportive and helpful in making DevOps a success.

3. Deploy Automation Technology: The level of automation chosen largely determines the nature of the development environment as well as production needs. The right tooling can go a long way in ensuring the latest codes are production ready and deployable.

Source: https://www.comakeit.com/blog/practical-implementation-of-devops-step-by-step/

Image Reference Source: https://techbeacon.com/devops/7-steps-choosing-right-devops-tools

In DevOps, any technology that helps automate processes is always helpful. Automation tools not only simplify the process of configuring, monitoring and maintaining infrastructure, they also help deploy applications faster. This also helps reduce the problems at the deployment stage. It is important to know that automation is a large part of the practice but not the entire point of this process.

4. Speed of Deployment: Usually development teams which deliver at the fastest cycle time are said to enjoy the highest business satisfaction. These teams also deliver the highest quality of software. Increasing the speed of deployment is one of the key goals in DevOps and in order to achieve this goal, companies often deploy technology which provides speed.

Along with this technology, agile development techniques also need to be implemented for organizations to keep in mind that these techniques are merely a means to achieve the final goals like faster deployment and better support of the business processes overall.

5. Increase Feedback from Operations: Only giving attention to the development side of DevOps is not sufficient. In order to optimize the benefits and increase efficiency the company needs to increase communication and collaboration within operations as well as with operations and the rest of the organization.

This helps development team to elevate delivery pipeline with amplified feedback as opposed to automated delivery and sub-optimization.

6. Establishing KPIs to Monitor Success:A clear framework needs to be outlined before taking on DevOps practices which show its true value for the organization. For any business to know if the transition or changes they have adopted are successful or beneficial, they need to keep an eye of key performance indicators.

Similarly to know if DevOps has a positive impact, a company simply needs to monitor the company KPIs. True value of these practices would be better leverage and agility of the technology to support business operations and hence the strategies need to have a quantifiable impact on the business KPIs.

7. Change the Business Process to Match the Development Pace: When changes are made in any part of the organization, other parts will also get affected. It is important to keep in mind the bigger picture to ensure the business process are aligned with the new pace being set by DevOps.

For example, the marketing company would need to step up and focus on the higher number of product launches and quicker turnaround times. Without adopting new processes, the internal teams would not be able to keep up with these more frequent launches. Collaborating with other departments is imperative to ensure the principles behind the DevOps philosophy are beneficial for the company.

Source: https://www.datamation.com/applications/9-best-practices-for-devops-1.html

Image reference source: https://www.mylearningkey.com/blog/en/devops-best-practices/

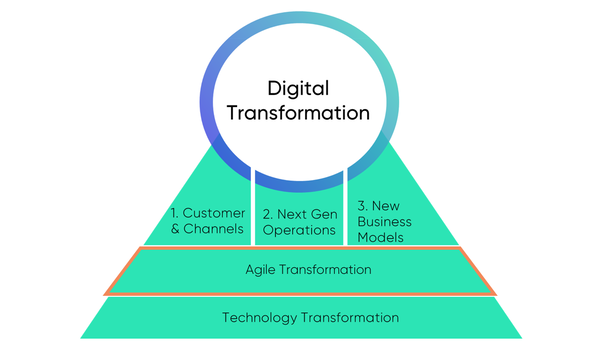

To Sum Up

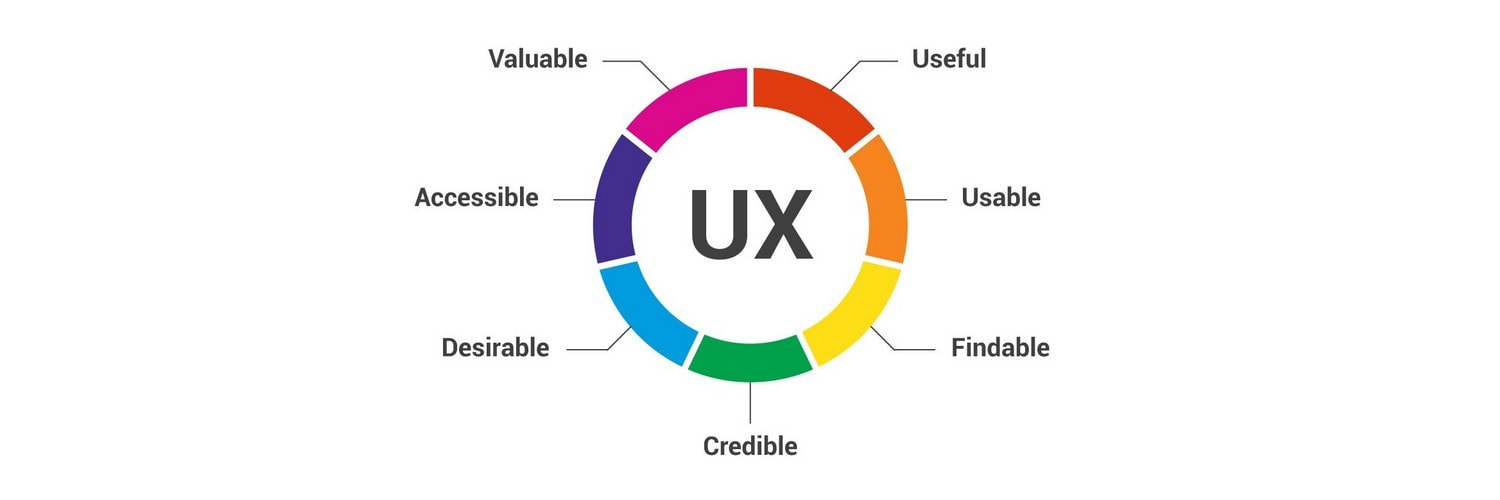

Software and the internet have changed the world we live in. Everything from industries to shopping to banking to entertainment. Companies are constantly interacting with their customers via apps on all sorts of devices and businesses need to make optimum use of this technology to deliver the best experience to their customers.

Despite a lack of a standard definition, it is safe to say that DevOps is a journey and not a destination. While most organizations are moving towards implementing these practices, they need to keep in mind it is a long term process with constant experimentation with new tools and processes.

If you would like to discuss DevOps tools and how they can benefit your organization, you can contact our App Scoop development team on:

https://app-scoop.com/contact-us.html.