The number of smartphone users in 2018 was 2.58 billion, worldwide. This number is going to increase and by 2022, Canada alone will have approximately 30 million smartphone users.

Source: https://www.statista.com/statistics/467190/forecast-of-smartphone-users-in-canada/

- iPhone – iOS

- Android- Google Inc.

- Nokia – Symbian OS

Building of mobile apps has become a lucrative business and a top priority for many companies. By the year 2020, the mobile app market would be worth approximately $189 billion US dollars.

Source: https://www.statista.com/statistics/269025/worldwide-mobile-app-revenue-forecast/

There are various types of apps which can be created for use on smartphones like native, hybrid and web. It is often difficult to choose a development approach as the lines between various options are starting to blur.

What is a Native App?

An application, written for a particular device or platform is a native mobile app. These apps are developed keeping in mind and, at the same time, taking advantage of the device operating systems features and its software.

For example,

- iPhone apps are written in Obj-C or Swift

- Android apps are written in Java or Kotlin

Since native apps are developed for particular operating systems, users can access them from the dedicated app stores like Google play for Android and App Store for iPhone. Some platforms provide app developers their own developmental tools and interface elements to create the necessary native apps.

Why Choose Native Apps?

Native app development gives the app developers more control over providing their users with the ultimate experience. If a business intends to use the app for interacting with customers it will need to provide a satisfactory user experience, leading to the continued use of the app. Hence using a native app is beneficial as it does not sacrifice the design elements and is still unique to each platform.

As mobile software is becoming a necessity for companies, it is imperious they are aware about the pros and cons of a particular developmental approach. Most companies invest in native mobile app development because of the significant benefits which come with it. Let us have a look at some key benefits of native mobile app development:

Optimum Speed and Performance

Patience is waning thin in today’s mobile users, where they expect everything instantly. Their expectation from the apps they use is no different.A smartphone allows a native app to leverage a devices processing speed, leading to a quicker load time since the content and visual elements are already on the phone.

Since a native app is created and customised for a specific platform, it shows a high level of performance and efficiency. These apps can directly access the device hardware and are created using the core programming language and API, thus providing a faster execution and fewer hic-ups.

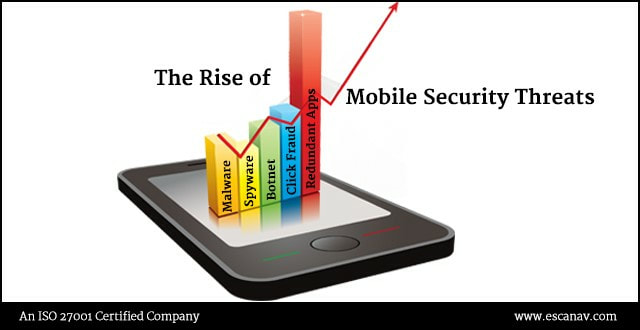

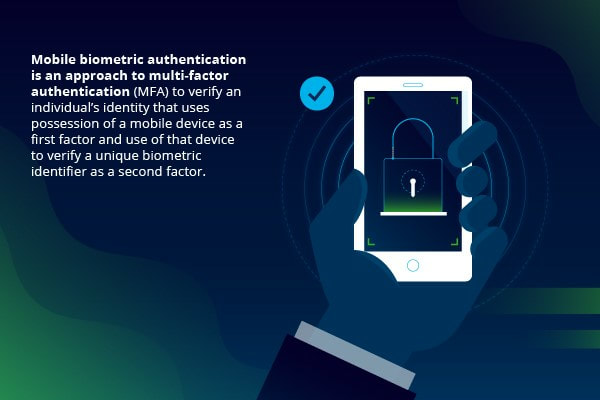

Higher Security

Being developed with the high end language of a specific platform, native apps offer users higher levels of security. Non-native apps are said to have more security issues as they depend on browsers, other core technologies and are subject to their non-standard behaviour.

For example, web apps are said to rely on underlying technologies like JavaScript, CSS and HTML5, which have non-standard nature and hence will lead to more security and performance issues. On the other hand, native apps have the added benefit of remote access and data can be erased remotely if necessary.

This is why developing a native app is a great way to ensure reliable users data protection as they receive more proactive security and upgrades of the platform itself.

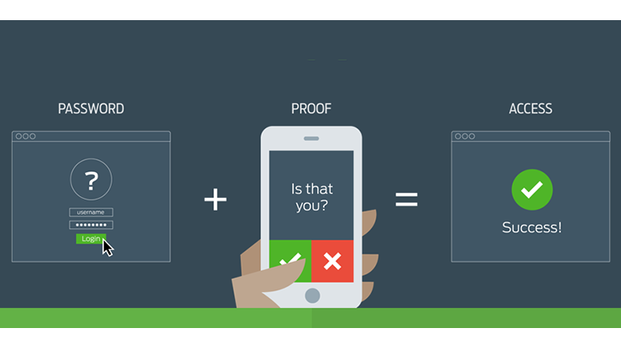

More Interactive and Intuitive Apps

Native apps run a lot smoother where users get to experience a seamless operation with the additional benefit of the operating systems interfaces. Since these apps are made for a particular system, a user gets the feel that the app is part of the device.

While web apps are made to look like native apps, they do not perform like them. The flow of the native app is more natural as it has specific UI standards, which allowing the user to interact with the app using gestures and actions they are familiar with, eliminating the learning curve.

Complete Access to All the Features of the App

Native apps allow the developers to get access to all the features of the operating system. Hence, the developer can take full advantage of the platforms software. The apps can also access the hardware of the device like:

- GPS facility

- Camera

- Microphone

- Push notifications

Accessing these functions could be challenging from non-native apps, but native apps have full access and the functions are carried out just as they would on the platform. This helps in executing the app faster and ultimately leads to an enhanced user experience. Non-native apps often have to access the hardware through a bridge leading to slow development and a frustrating user experience.

Fewer Bugs During Development

Native apps make it possible to have fewer discrepancies, limiting the chances of bugs and the developer is not relying on a cross-platform tool like Xamarin or Cordova. Developers would find it challenging to manage two different applications in one codebase in comparison to managing the same in two codebases. This is where native app wins the battle.

New Features

This problem is more prominent when new versions of the platform are released. Native app developers have easy access to the new software developmental kits (SDK) to build or modify their apps with the latest features which is beneficial to the app and the clients business. Non-native approaches however would need to wait till the latest version is updated before gaining access to the platforms new features.

Working Offline

Web apps only work when they are connected to the internet, which can pose a problem if the user is on the go or at a remote location. Native apps on the other hand can function independently without the internet. This is a major advantage and the app can even function in the offline mode if needed.

People may debate that the cost of native apps is higher than that of hybrid and web apps. Yes, initial costs may be higher but this is a one-time investment which will benefit the business in the long run. Whichever approach is chosen by the business, the app must be quick, receptive and dependable.

Users are demanding more from their mobile experiences and in order to meet their expectations, hence it is imperative to deliver a high performance product. By offering a vital and more personalized user experience, better performance and benefits of the device features, the native mobile app will result in higher customer retention and boost customer loyalty.

If you would like to know more about mobile app development, you can contact the App Scoop mobile app development team: https://app-scoop.com/contact-us.html.